As cloud environments scale, enterprise leaders face a common challenge: cloud costs are visible, but not always meaningful. Traditional financial metrics often fail to explain whether cloud spending is driving real business value.

This is where FinOps metrics play a critical role.

FinOps metrics help organizations measure cloud efficiency, accountability, and outcomes — not just raw spend. In this article, we explore the most important FinOps metrics for enterprises and how they are used across finance, engineering, and leadership teams.

What Are FinOps Metrics?

FinOps metrics are measurements that help organizations understand, manage, and optimize cloud spending in relation to business value.

Unlike traditional IT metrics, FinOps metrics focus on:

- Usage-based costs

- Shared ownership

- Continuous optimization

- Alignment between cost and outcomes

If you’re new to FinOps, start with our foundational guide:

What Is FinOps? A Complete Guide to Cloud Financial Management

Why Traditional Cloud Cost Metrics Fall Short

Many enterprises rely on high-level metrics such as total cloud spend or monthly variance. While useful, these numbers don’t answer critical questions like:

- Which teams are driving cost increases?

- Are costs proportional to growth?

- Which workloads deliver the most value?

FinOps metrics provide context, enabling better decisions rather than reactive cost cutting.

Core FinOps Metrics for Enterprises

1. Cost Allocation Coverage

Measures how much of total cloud spend is accurately allocated to teams, products, or services.

High allocation coverage is foundational for accountability and chargeback or showback models.

2. Unit Cost Metrics

Unit metrics connect cloud spend to business drivers, such as:

- Cost per customer

- Cost per transaction

- Cost per workload

These metrics allow enterprises to scale while maintaining cost efficiency.

3. Waste and Efficiency Metrics

Used to identify inefficiencies, including:

- Idle resources

- Underutilized compute

- Orphaned storage

These metrics support optimization initiatives without compromising performance.

4. Forecast Accuracy

Measures how closely cloud spend aligns with forecasts over time.

Improving forecast accuracy helps finance teams plan better in highly dynamic environments.

Best Practices for Forecast Accuracy in FinOps

Improving forecast accuracy is more than just refining a number, it’s about building trust between finance, engineering, and leadership teams. Below are proven practices that help large enterprises increase the precision and value of their cloud forecasting efforts:

- Use historical data with context: Start with reliable historical usage and cost data. If consistent trends exist, time-series models can perform well. When historical data is limited, complement it with scenario modeling or market-based assumptions.

- Automate and standardize inputs: Forecasting is only as good as the data that feeds it. Use automated tools to ingest, clean, and validate data. Enforce consistent tagging, eliminate anomalies early, and ensure common standards across teams.

- Stay conservative — but not rigid: Conservative forecasting helps avoid overcommitting budgets or underestimating spend. But too much caution can lead to missed opportunities. A good practice is to build multiple forecast scenarios (baseline, growth, risk) and review them together.

- Incorporate non-financial signals: Cloud costs are shaped by more than usage patterns. Include data such as hiring plans, product launches, and migration roadmaps. These business signals provide crucial forward-looking context.

- Communicate clearly: Forecasts should be understandable by stakeholders across finance, engineering, and product. Avoid black-box models. Use narratives, visuals, and clear assumptions to drive alignment.

- Review and update frequently: Forecasts lose accuracy over time. Set regular checkpoints (monthly or quarterly) to review variance and adjust assumptions. Use tools like Lighthouse Forecasting to track actuals vs predictions.

- Measure forecast performance: Define KPIs such as:

Forecast Accuracy = 1 - (|Forecasted Spend - Actual Spend| / Forecasted Spend)

Track deviations over time and use this insight to refine your methodology.

5. Optimization Impact

Tracks the results of optimization efforts, such as:

- Savings achieved

- Performance improvements

- Reliability maintained

This metric reinforces a value-driven FinOps culture. ess into a governance function — enabling better planning, fewer surprises, and higher accountability.

FinOps Metrics Across the Lifecycle

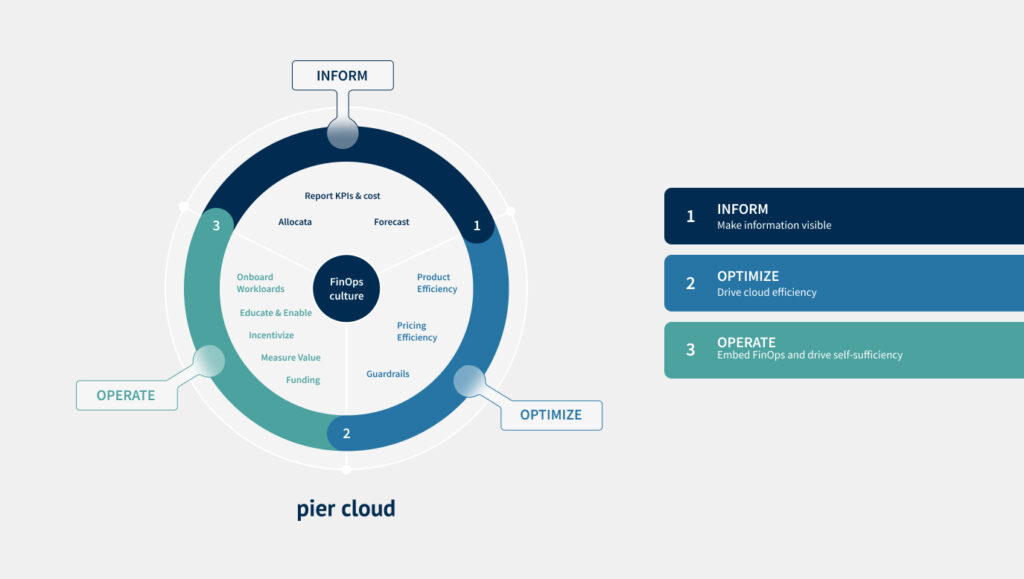

FinOps metrics evolve as organizations mature through the lifecycle:

- Inform phase: allocation coverage, visibility metrics

- Optimize phase: unit costs, efficiency metrics

- Operate phase: forecasting accuracy, governance KPIs

Learn how these phases work together in the FinOps lifecycle:

FinOps Lifecycle Explained

Who Uses FinOps Metrics?

In large enterprises, different stakeholders rely on different metrics:

- Engineering teams focus on efficiency and unit costs

- Finance teams prioritize forecasting and accountability

- Executives care about trends, value, and business outcomes

A successful FinOps practice aligns all audiences around a shared metrics framework.

Final Thoughts

FinOps metrics are not just reports — they are tools for decision-making.

By adopting the right metrics, enterprises gain:

- Clear accountability

- Better financial governance

- Scalable cloud operations

Metrics turn cloud cost management into a strategic capability rather than a reactive function.